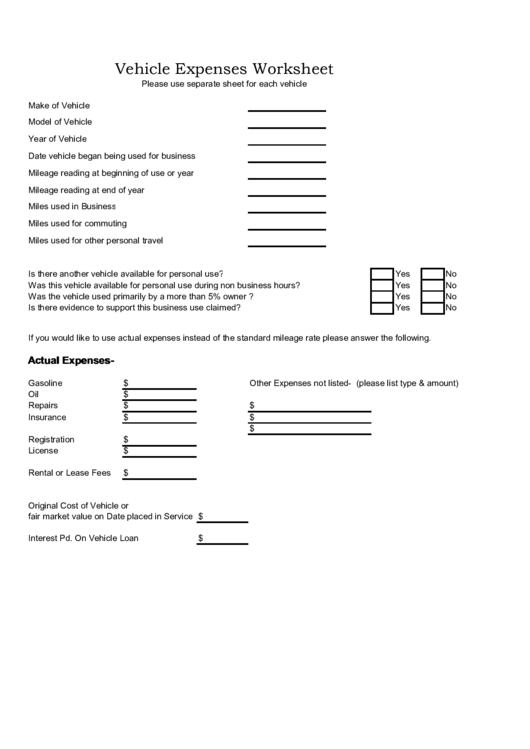

Vehicle Expenses Worksheet - Download or submit this worksheet to provide your vehicle expenses and mileage information for. * please note the irs requires mileage logs to be maintained to substantiate a business deduction. The purpose of this worksheet is to help you organize your tax deductible business expenses. The purpose of this worksheet is to help you organize your tax deductible business expenses. Auto expense worksheet fill out for both mileage & actual expense methods vehicle.

Auto expense worksheet fill out for both mileage & actual expense methods vehicle. * please note the irs requires mileage logs to be maintained to substantiate a business deduction. The purpose of this worksheet is to help you organize your tax deductible business expenses. Download or submit this worksheet to provide your vehicle expenses and mileage information for. The purpose of this worksheet is to help you organize your tax deductible business expenses.

Download or submit this worksheet to provide your vehicle expenses and mileage information for. * please note the irs requires mileage logs to be maintained to substantiate a business deduction. The purpose of this worksheet is to help you organize your tax deductible business expenses. Auto expense worksheet fill out for both mileage & actual expense methods vehicle. The purpose of this worksheet is to help you organize your tax deductible business expenses.

Tax Expenses Worksheet For Vehicle Expenses

The purpose of this worksheet is to help you organize your tax deductible business expenses. Auto expense worksheet fill out for both mileage & actual expense methods vehicle. * please note the irs requires mileage logs to be maintained to substantiate a business deduction. The purpose of this worksheet is to help you organize your tax deductible business expenses. Download.

Vehicle Expenses Worksheet printable pdf download

The purpose of this worksheet is to help you organize your tax deductible business expenses. * please note the irs requires mileage logs to be maintained to substantiate a business deduction. The purpose of this worksheet is to help you organize your tax deductible business expenses. Download or submit this worksheet to provide your vehicle expenses and mileage information for..

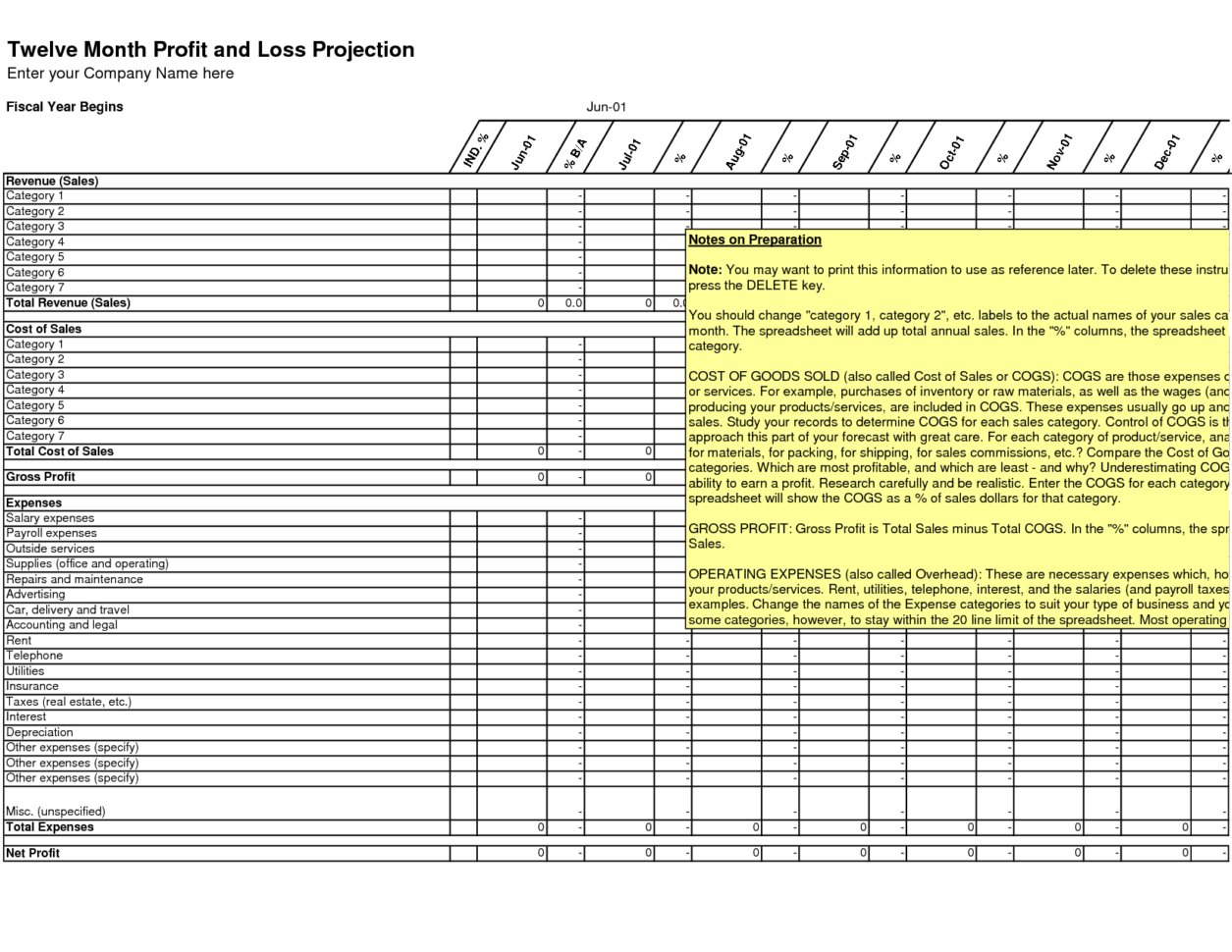

Car Expenses Excel Spreadsheet Google Spreadshee car expenses excel

Auto expense worksheet fill out for both mileage & actual expense methods vehicle. The purpose of this worksheet is to help you organize your tax deductible business expenses. Download or submit this worksheet to provide your vehicle expenses and mileage information for. The purpose of this worksheet is to help you organize your tax deductible business expenses. * please note.

Car Expenses Excel Spreadsheet Google Spreadshee car expenses excel

Download or submit this worksheet to provide your vehicle expenses and mileage information for. The purpose of this worksheet is to help you organize your tax deductible business expenses. The purpose of this worksheet is to help you organize your tax deductible business expenses. * please note the irs requires mileage logs to be maintained to substantiate a business deduction..

Car Expenses Excel Spreadsheet Google Spreadshee car expenses excel

The purpose of this worksheet is to help you organize your tax deductible business expenses. * please note the irs requires mileage logs to be maintained to substantiate a business deduction. Auto expense worksheet fill out for both mileage & actual expense methods vehicle. The purpose of this worksheet is to help you organize your tax deductible business expenses. Download.

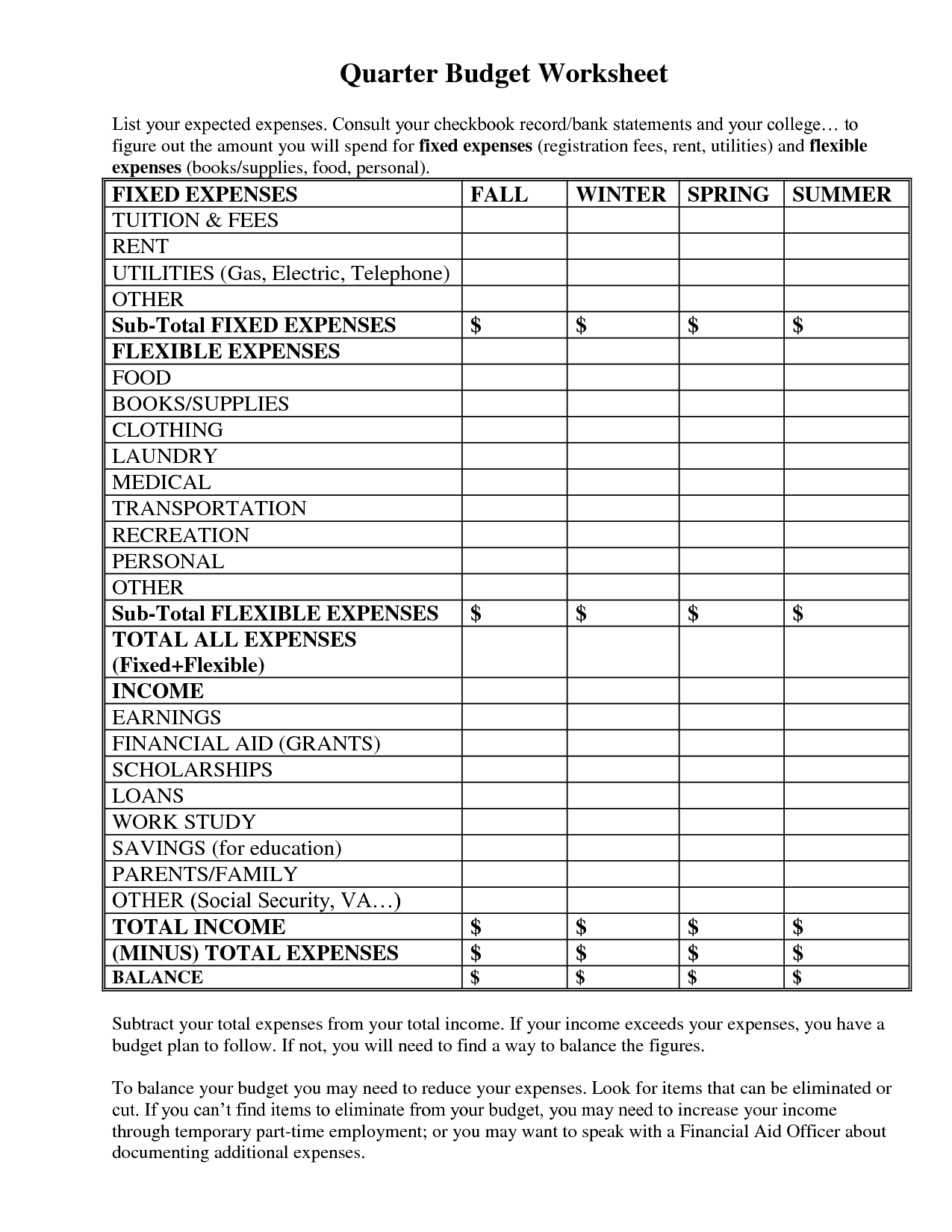

Vehicle Expense Worksheet

The purpose of this worksheet is to help you organize your tax deductible business expenses. The purpose of this worksheet is to help you organize your tax deductible business expenses. Auto expense worksheet fill out for both mileage & actual expense methods vehicle. Download or submit this worksheet to provide your vehicle expenses and mileage information for. * please note.

Auto Expense Worksheet Vehicle Expense Spreadsheet Excel Template

The purpose of this worksheet is to help you organize your tax deductible business expenses. Auto expense worksheet fill out for both mileage & actual expense methods vehicle. The purpose of this worksheet is to help you organize your tax deductible business expenses. Download or submit this worksheet to provide your vehicle expenses and mileage information for. * please note.

Vehicle Expense Tracker Manage Your Car Expenses Easily

Auto expense worksheet fill out for both mileage & actual expense methods vehicle. Download or submit this worksheet to provide your vehicle expenses and mileage information for. The purpose of this worksheet is to help you organize your tax deductible business expenses. The purpose of this worksheet is to help you organize your tax deductible business expenses. * please note.

20++ Car And Truck Expenses Worksheet Worksheets Decoomo

* please note the irs requires mileage logs to be maintained to substantiate a business deduction. The purpose of this worksheet is to help you organize your tax deductible business expenses. Auto expense worksheet fill out for both mileage & actual expense methods vehicle. The purpose of this worksheet is to help you organize your tax deductible business expenses. Download.

Car Expenses Excel Spreadsheet Google Spreadshee car expenses excel

The purpose of this worksheet is to help you organize your tax deductible business expenses. * please note the irs requires mileage logs to be maintained to substantiate a business deduction. Auto expense worksheet fill out for both mileage & actual expense methods vehicle. The purpose of this worksheet is to help you organize your tax deductible business expenses. Download.

Download Or Submit This Worksheet To Provide Your Vehicle Expenses And Mileage Information For.

Auto expense worksheet fill out for both mileage & actual expense methods vehicle. The purpose of this worksheet is to help you organize your tax deductible business expenses. The purpose of this worksheet is to help you organize your tax deductible business expenses. * please note the irs requires mileage logs to be maintained to substantiate a business deduction.