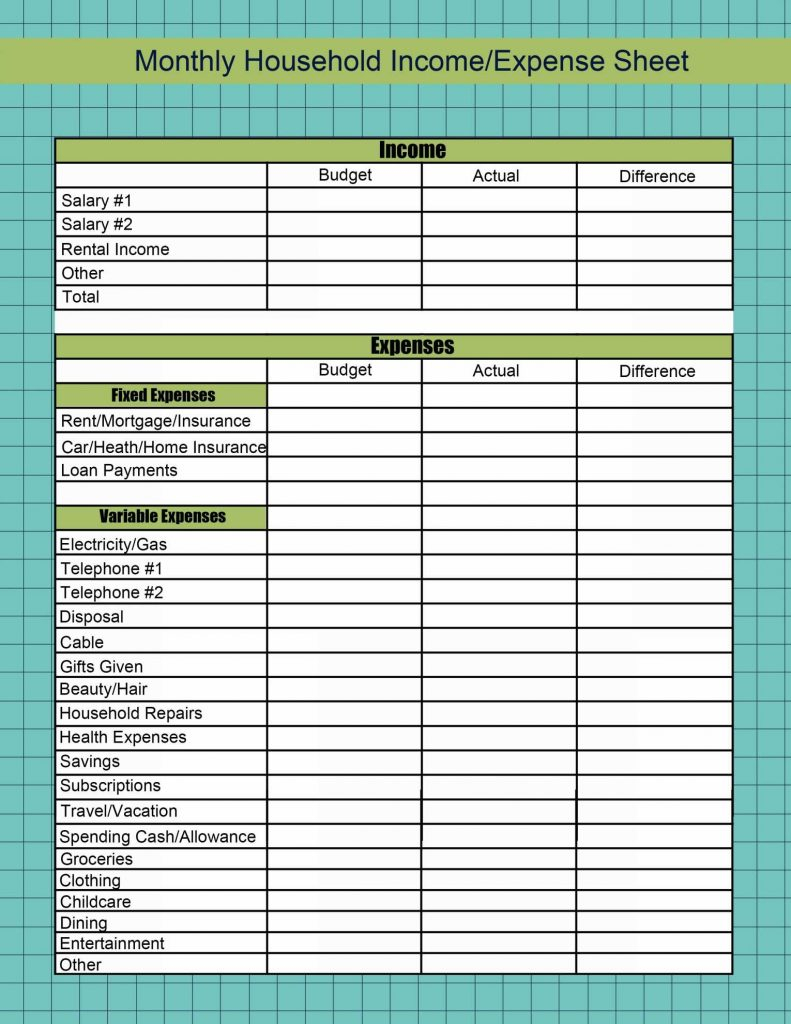

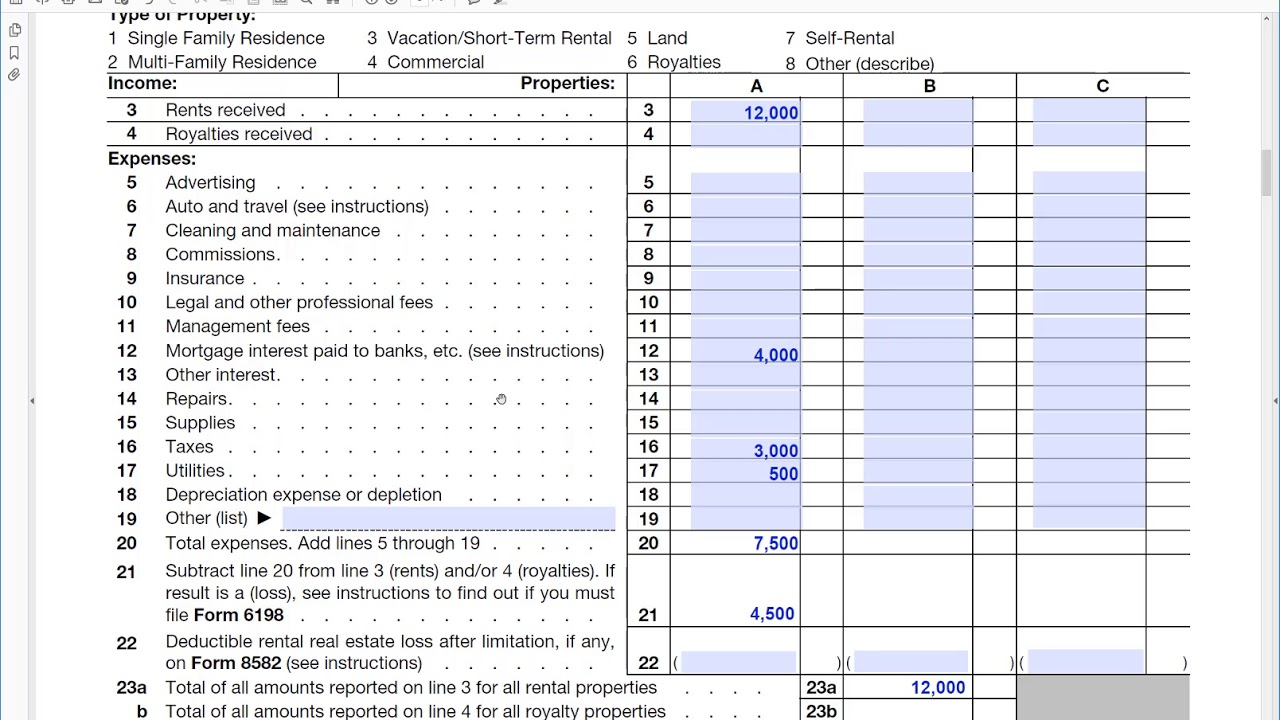

Schedule E Rental Income Worksheet - Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. Kind of property street address city, state & zip code. Information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on. Form 92 is a tool to help the seller calculate and document the calculation of net rental income from schedule e; The seller’s calculations must be. Rental property or royalty income worksheet (schedule e) did any of the above properties have personal use in 2024?

Information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on. Form 92 is a tool to help the seller calculate and document the calculation of net rental income from schedule e; Rental property or royalty income worksheet (schedule e) did any of the above properties have personal use in 2024? The seller’s calculations must be. Kind of property street address city, state & zip code. Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual.

The seller’s calculations must be. Form 92 is a tool to help the seller calculate and document the calculation of net rental income from schedule e; Kind of property street address city, state & zip code. Information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on. Rental property or royalty income worksheet (schedule e) did any of the above properties have personal use in 2024? Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual.

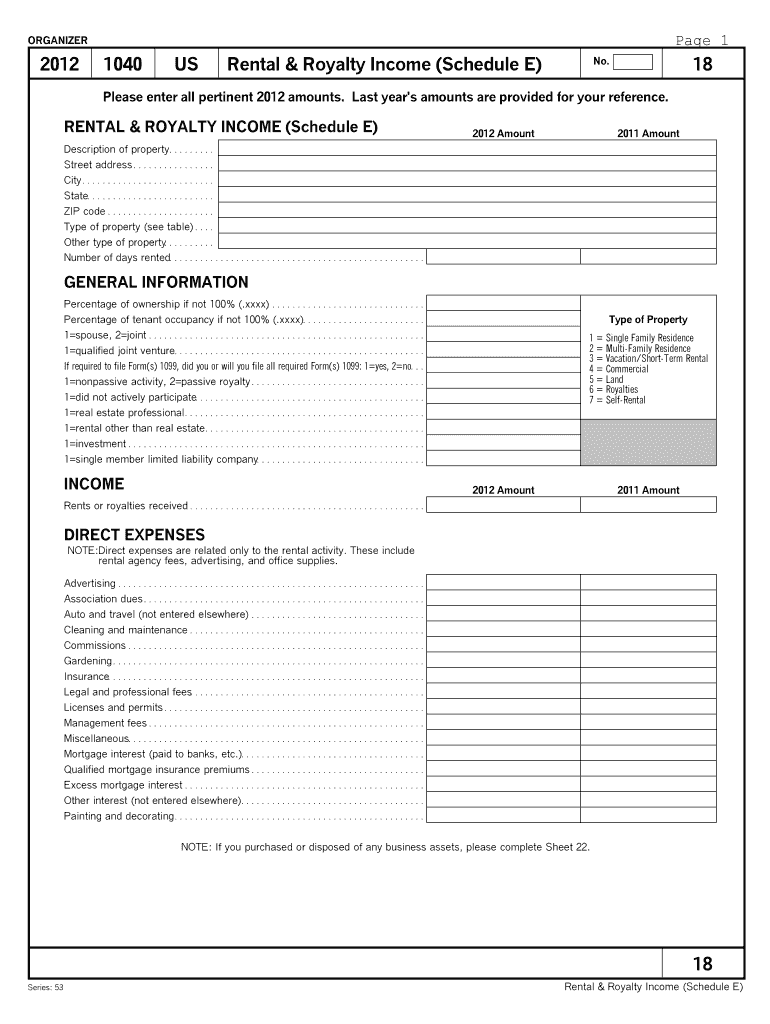

Schedule E Rental Worksheet Excel

Kind of property street address city, state & zip code. Information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on. Form 92 is a tool to help the seller calculate and document the calculation of net rental income from schedule e; The seller’s calculations must be. Rental property or royalty income worksheet.

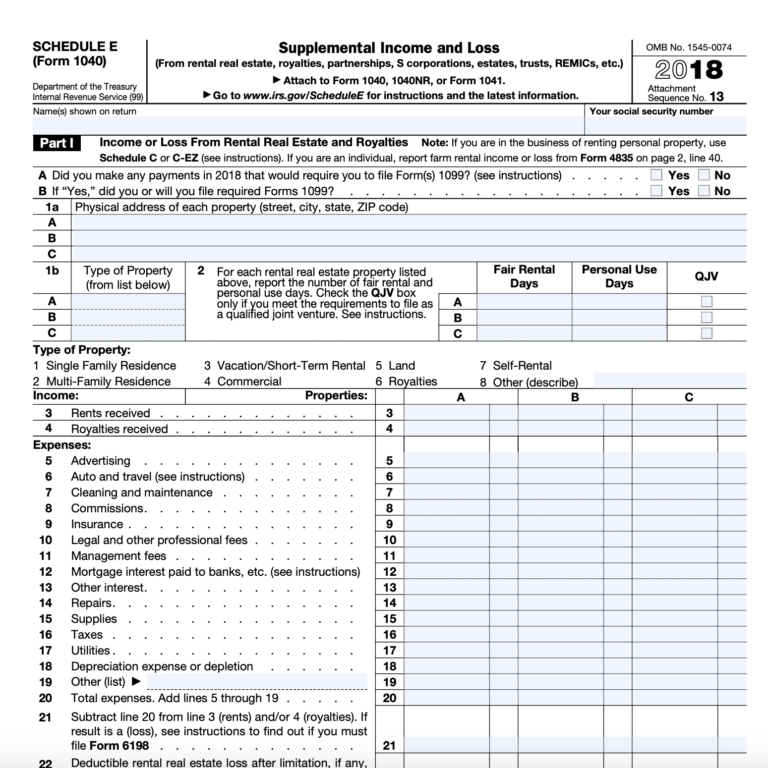

Rental Schedule E

Rental property or royalty income worksheet (schedule e) did any of the above properties have personal use in 2024? Information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on. The seller’s calculations must be. Kind of property street address city, state & zip code. Form 92 is a tool to help the.

Schedule E Worksheet For Rental Property

Kind of property street address city, state & zip code. The seller’s calculations must be. Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. Rental property or royalty income worksheet (schedule e) did any of the above properties have personal use in 2024? Form 92 is a.

Schedule E Rental Worksheet Excel

Form 92 is a tool to help the seller calculate and document the calculation of net rental income from schedule e; Information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on. Rental property or royalty income worksheet (schedule e) did any of the above properties have personal use in 2024? The seller’s.

Schedule E Rental Worksheet Excel

Form 92 is a tool to help the seller calculate and document the calculation of net rental income from schedule e; Information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on. Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and.

Schedule E Calculation Worksheet

Information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on. Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. The seller’s calculations must be. Rental property or royalty income worksheet (schedule e) did any of the above properties have.

What Is Schedule E Here S An Overview For Your Rental 2021 Tax Forms

The seller’s calculations must be. Rental property or royalty income worksheet (schedule e) did any of the above properties have personal use in 2024? Information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on. Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations,.

Schedule E Rental Worksheet Excel 2021

Rental property or royalty income worksheet (schedule e) did any of the above properties have personal use in 2024? Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. Kind of property street address city, state & zip code. Information about schedule e (form 1040), supplemental income and.

Schedule E Calculate Rental

The seller’s calculations must be. Form 92 is a tool to help the seller calculate and document the calculation of net rental income from schedule e; Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. Information about schedule e (form 1040), supplemental income and loss, including recent.

Free IRS Tax Form 1040 Schedule E Template Google Sheets & Excel

Rental property or royalty income worksheet (schedule e) did any of the above properties have personal use in 2024? The seller’s calculations must be. Kind of property street address city, state & zip code. Information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on. Form 92 is a tool to help the.

Use Schedule E (Form 1040) To Report Income Or Loss From Rental Real Estate, Royalties, Partnerships, S Corporations, Estates, Trusts, And Residual.

Information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on. The seller’s calculations must be. Form 92 is a tool to help the seller calculate and document the calculation of net rental income from schedule e; Kind of property street address city, state & zip code.