Internal Rate Of Return Excel Template - The internal rate of return (irr)—or the discounted cash flow rate of return—is the discount rate that makes the net present value equal to zero. Internal rate of return (irr) is a discount rate that is used to identify potential/future investments that may be profitable.

The internal rate of return (irr)—or the discounted cash flow rate of return—is the discount rate that makes the net present value equal to zero. Internal rate of return (irr) is a discount rate that is used to identify potential/future investments that may be profitable.

The internal rate of return (irr)—or the discounted cash flow rate of return—is the discount rate that makes the net present value equal to zero. Internal rate of return (irr) is a discount rate that is used to identify potential/future investments that may be profitable.

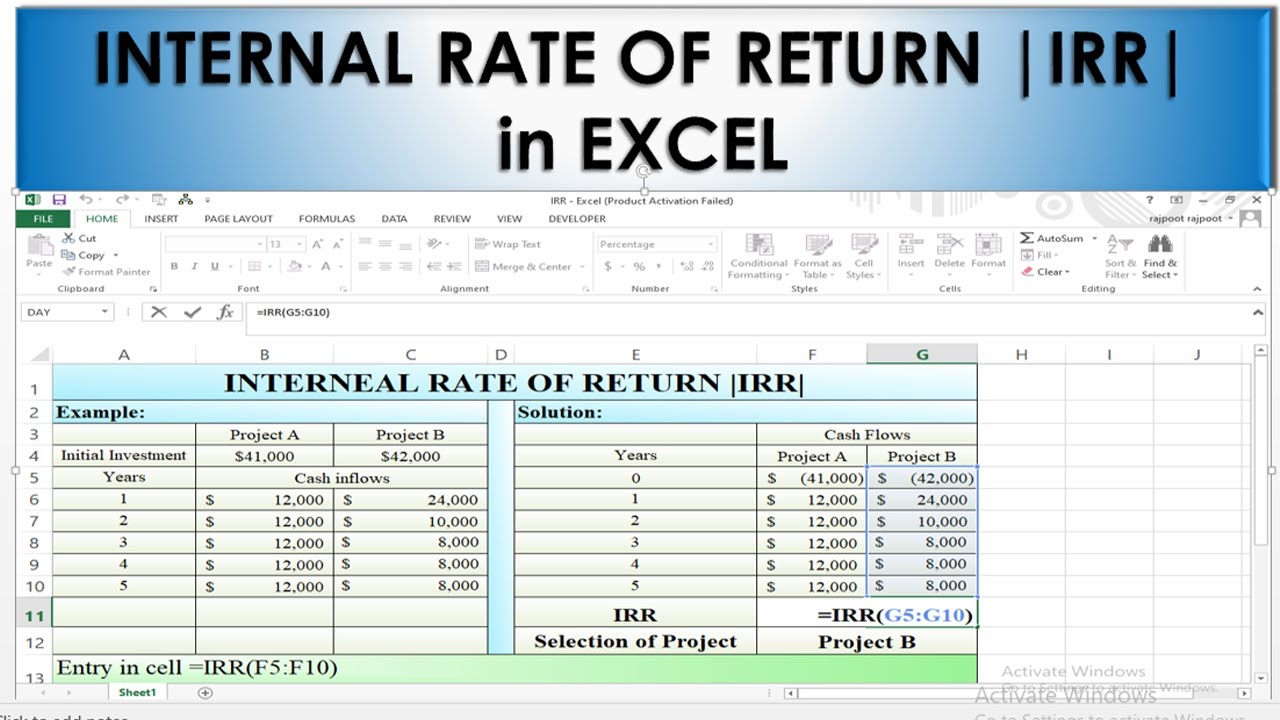

How to Calculate IRR in excel Internal Rate of return YouTube

Internal rate of return (irr) is a discount rate that is used to identify potential/future investments that may be profitable. The internal rate of return (irr)—or the discounted cash flow rate of return—is the discount rate that makes the net present value equal to zero.

Microsoft Excel 3 ways to calculate internal rate of return in Excel

The internal rate of return (irr)—or the discounted cash flow rate of return—is the discount rate that makes the net present value equal to zero. Internal rate of return (irr) is a discount rate that is used to identify potential/future investments that may be profitable.

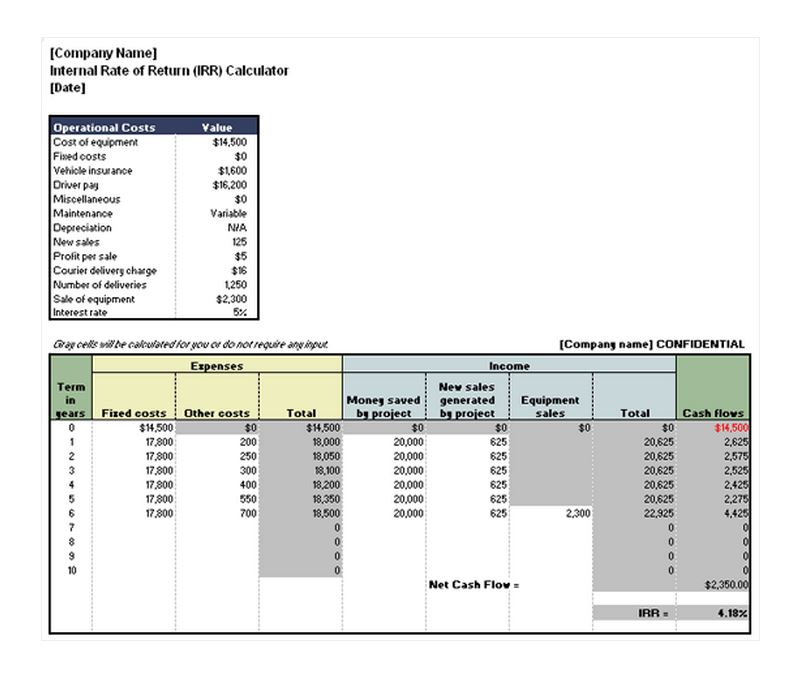

Internal Rate Of Return Excel Template

The internal rate of return (irr)—or the discounted cash flow rate of return—is the discount rate that makes the net present value equal to zero. Internal rate of return (irr) is a discount rate that is used to identify potential/future investments that may be profitable.

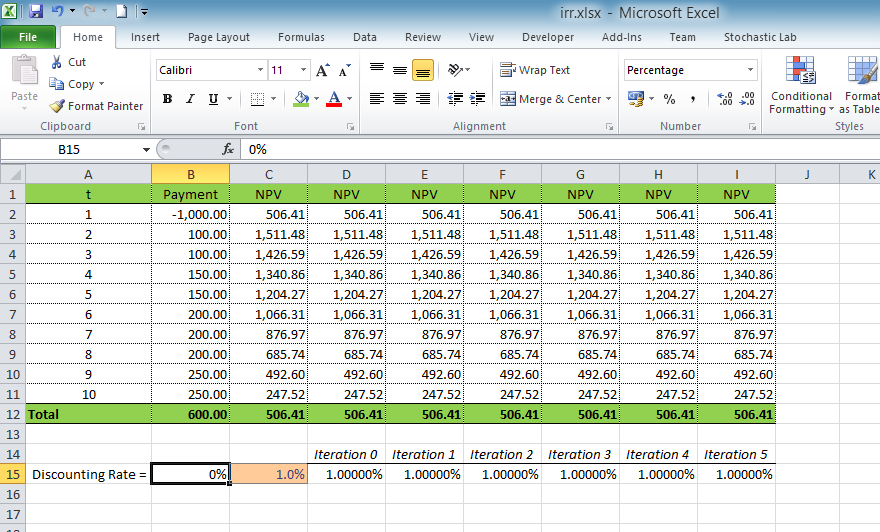

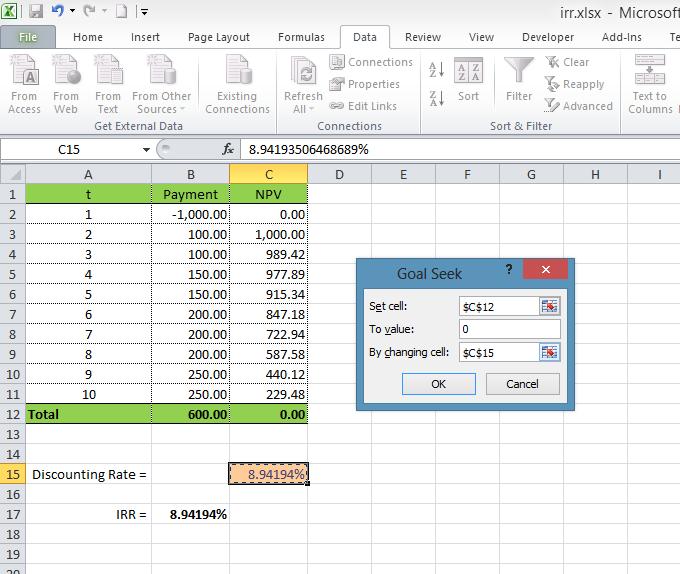

Calculating Internal Rate of Return (IRR) using Excel Excel VBA Templates

The internal rate of return (irr)—or the discounted cash flow rate of return—is the discount rate that makes the net present value equal to zero. Internal rate of return (irr) is a discount rate that is used to identify potential/future investments that may be profitable.

Calculating Internal Rate of Return (IRR) using Excel Excel VBA Templates

Internal rate of return (irr) is a discount rate that is used to identify potential/future investments that may be profitable. The internal rate of return (irr)—or the discounted cash flow rate of return—is the discount rate that makes the net present value equal to zero.

Internal Rate of Return (IRR) Excel Template • 365 Financial Analyst

Internal rate of return (irr) is a discount rate that is used to identify potential/future investments that may be profitable. The internal rate of return (irr)—or the discounted cash flow rate of return—is the discount rate that makes the net present value equal to zero.

How to Calculate an Internal Rate of Return (IRR) in Excel

Internal rate of return (irr) is a discount rate that is used to identify potential/future investments that may be profitable. The internal rate of return (irr)—or the discounted cash flow rate of return—is the discount rate that makes the net present value equal to zero.

12 Internal Rate Of Return Excel Template Excel Templates Excel

Internal rate of return (irr) is a discount rate that is used to identify potential/future investments that may be profitable. The internal rate of return (irr)—or the discounted cash flow rate of return—is the discount rate that makes the net present value equal to zero.

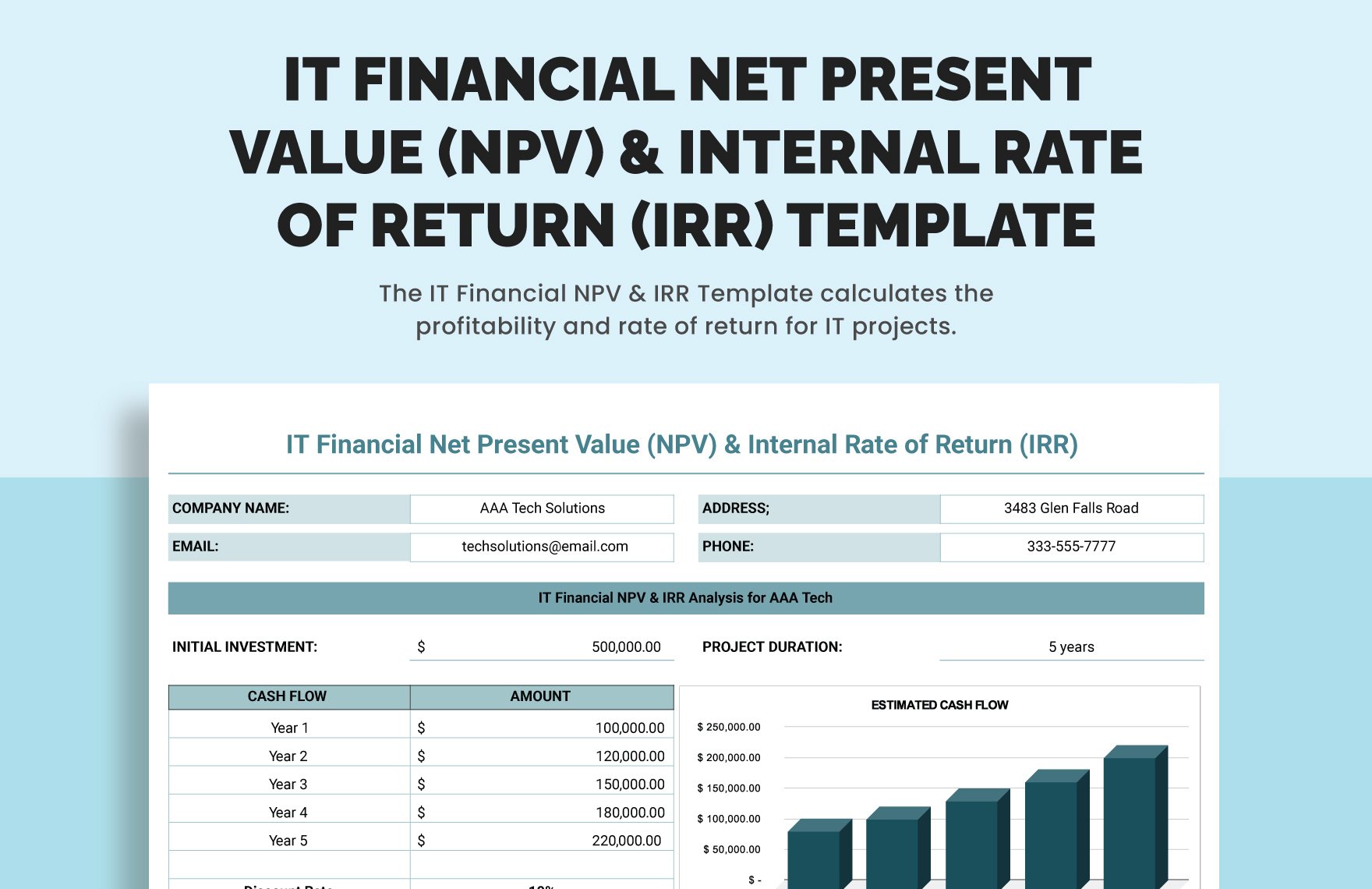

IT Financial Net Present Value (NPV) & Internal Rate of Return (IRR

Internal rate of return (irr) is a discount rate that is used to identify potential/future investments that may be profitable. The internal rate of return (irr)—or the discounted cash flow rate of return—is the discount rate that makes the net present value equal to zero.

Internal Rate Of Return Method Excel Template XLSX Excel Free

Internal rate of return (irr) is a discount rate that is used to identify potential/future investments that may be profitable. The internal rate of return (irr)—or the discounted cash flow rate of return—is the discount rate that makes the net present value equal to zero.

Internal Rate Of Return (Irr) Is A Discount Rate That Is Used To Identify Potential/Future Investments That May Be Profitable.

The internal rate of return (irr)—or the discounted cash flow rate of return—is the discount rate that makes the net present value equal to zero.