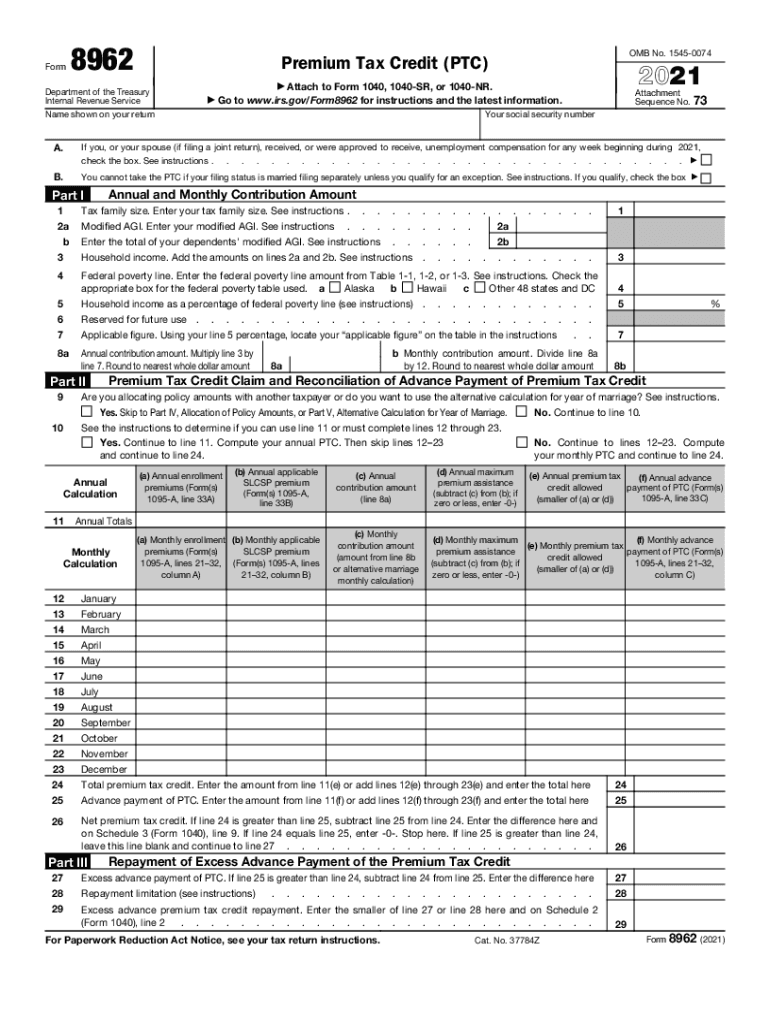

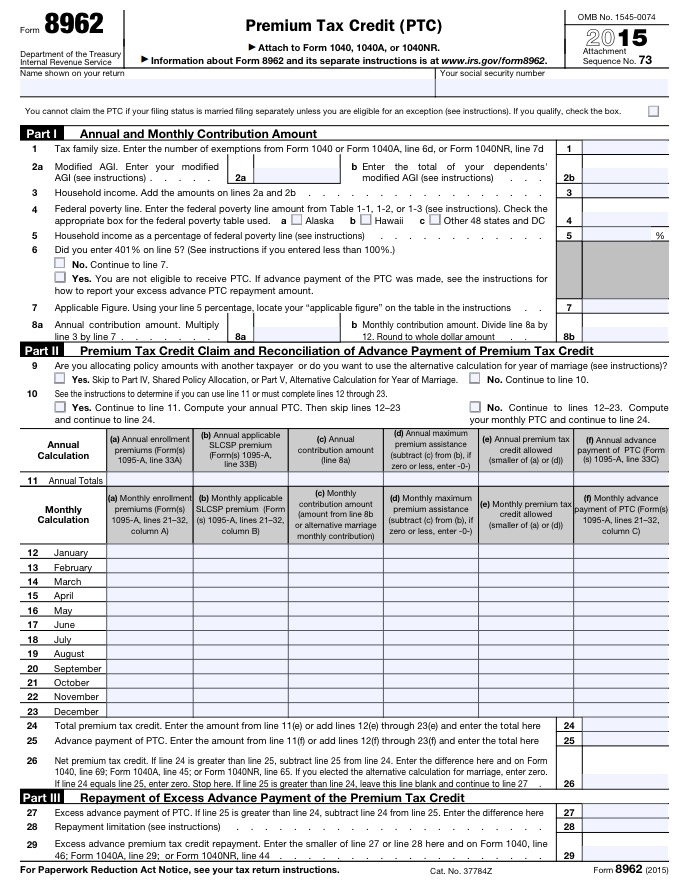

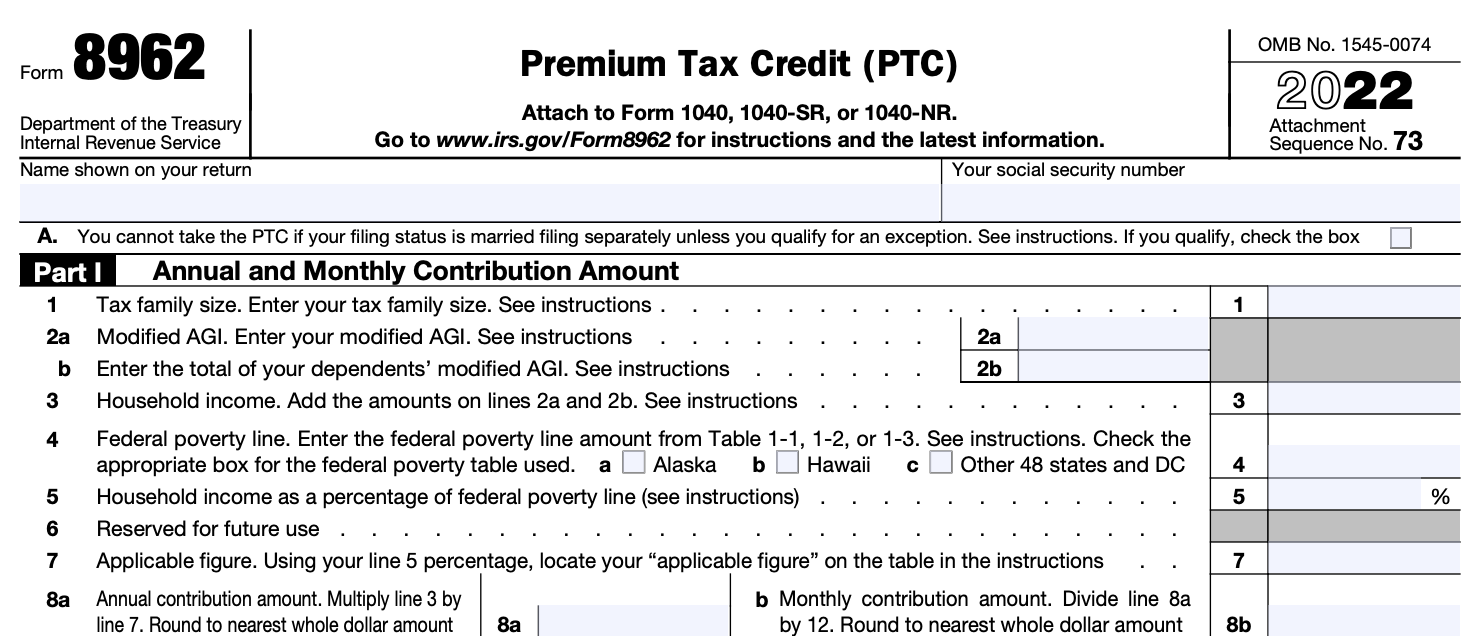

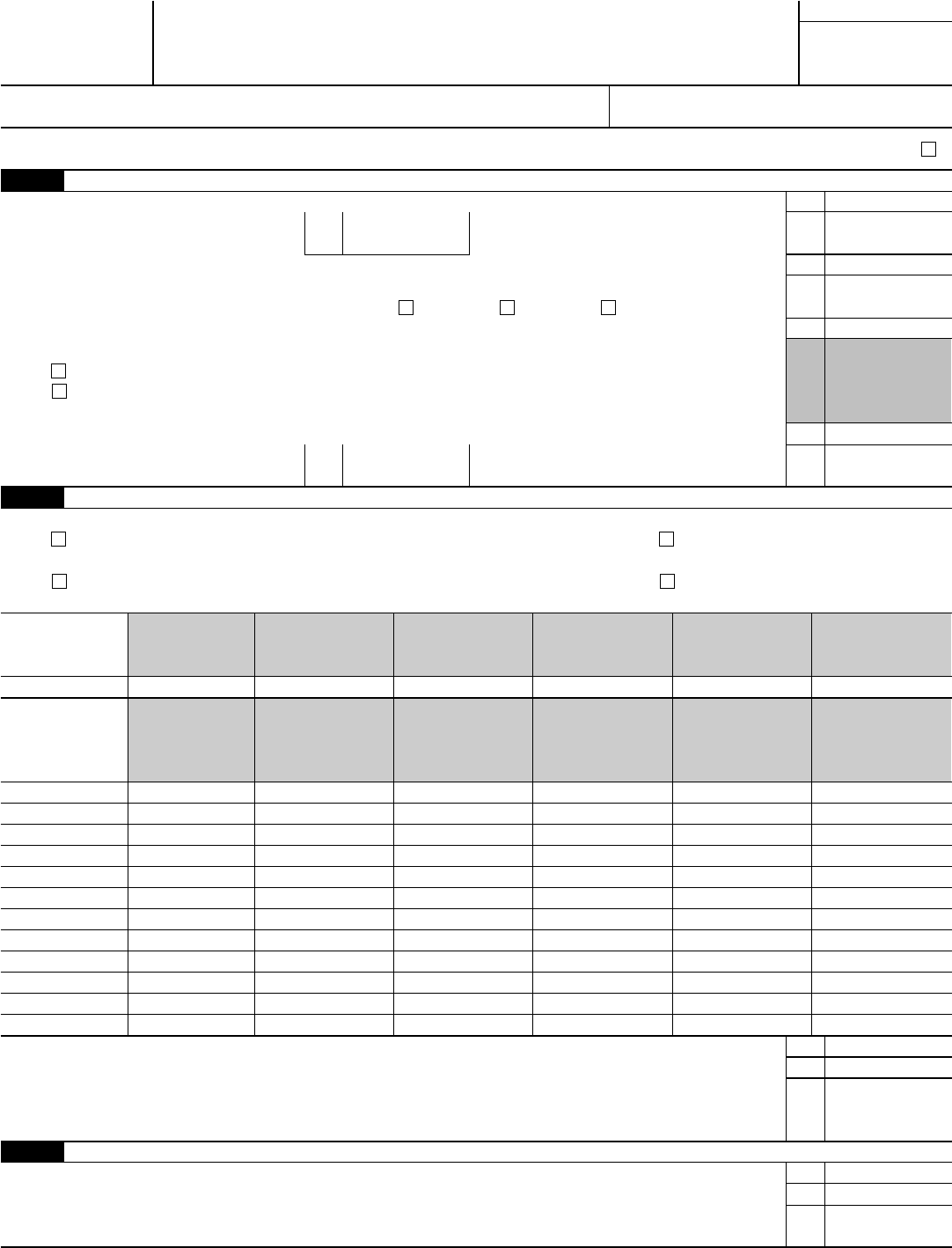

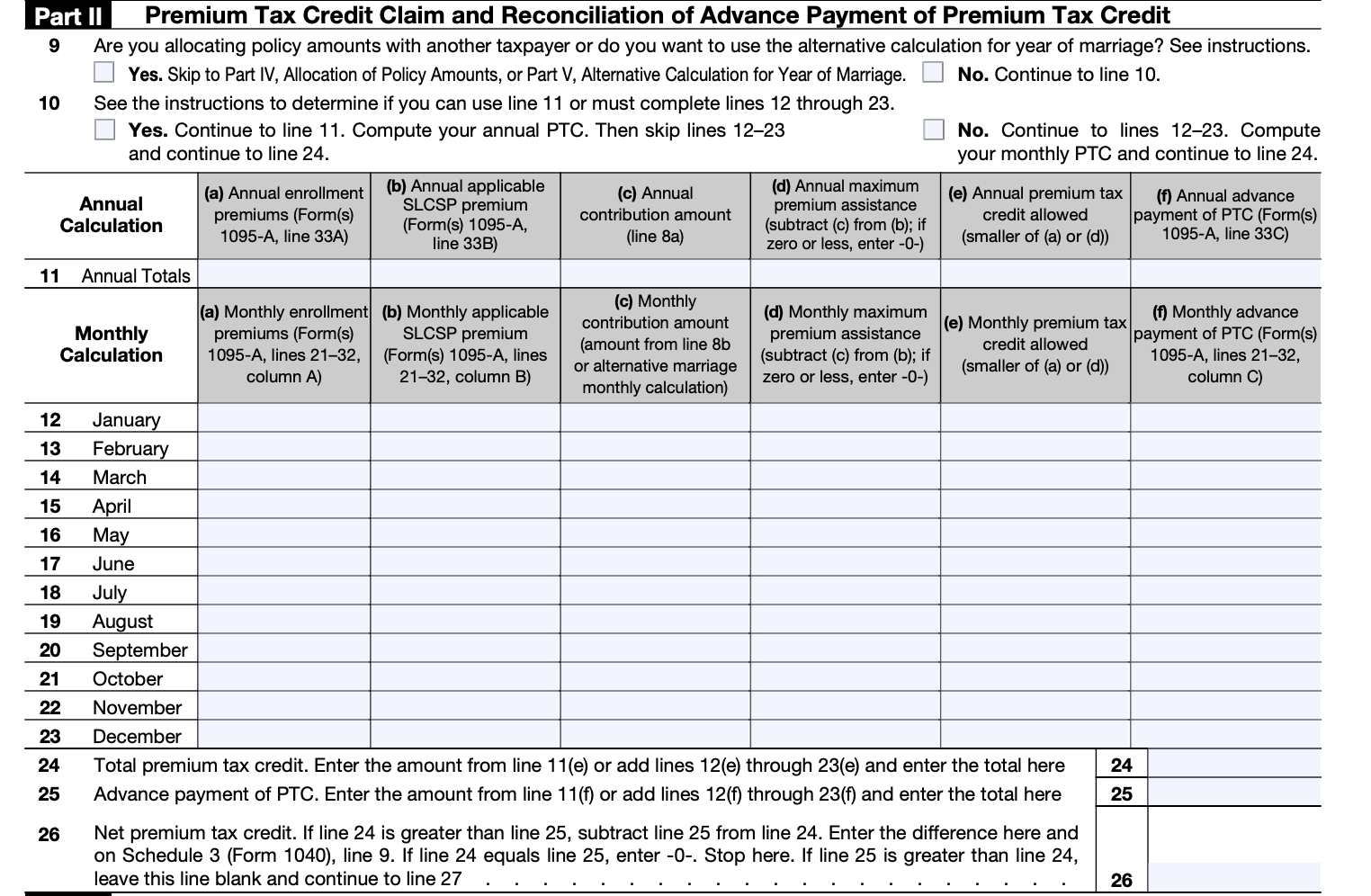

8962 Form 2021 Printable - 100k+ visitors in the past month Form 8962, premium tax credit (ptc), calculates the amount of premium tax credit that you are allowed to claim if you have premiums for your health. Use form 8962 to “reconcile” your premium tax credit — compare. Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium, or (2) to claim a.

Use form 8962 to “reconcile” your premium tax credit — compare. Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium, or (2) to claim a. Form 8962, premium tax credit (ptc), calculates the amount of premium tax credit that you are allowed to claim if you have premiums for your health. 100k+ visitors in the past month

100k+ visitors in the past month Use form 8962 to “reconcile” your premium tax credit — compare. Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium, or (2) to claim a. Form 8962, premium tax credit (ptc), calculates the amount of premium tax credit that you are allowed to claim if you have premiums for your health.

Tax Form 8962 Printable

100k+ visitors in the past month Use form 8962 to “reconcile” your premium tax credit — compare. Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium, or (2) to claim a. Form 8962, premium tax credit (ptc), calculates the amount of premium tax credit that you are.

IRS 8962 20212022 Fill and Sign Printable Template Online US Legal

100k+ visitors in the past month Use form 8962 to “reconcile” your premium tax credit — compare. Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium, or (2) to claim a. Form 8962, premium tax credit (ptc), calculates the amount of premium tax credit that you are.

How to Fill out IRS Form 8962 Correctly?

Use form 8962 to “reconcile” your premium tax credit — compare. Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium, or (2) to claim a. Form 8962, premium tax credit (ptc), calculates the amount of premium tax credit that you are allowed to claim if you have.

Form 8962 Fillable Pdf Printable Forms Free Online

Use form 8962 to “reconcile” your premium tax credit — compare. Form 8962, premium tax credit (ptc), calculates the amount of premium tax credit that you are allowed to claim if you have premiums for your health. Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium, or.

8962 Form 2021 Printable

Form 8962, premium tax credit (ptc), calculates the amount of premium tax credit that you are allowed to claim if you have premiums for your health. 100k+ visitors in the past month Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium, or (2) to claim a. Use.

All About IRS Form 8962 and Calculating Your Premium Tax Credit Nasdaq

100k+ visitors in the past month Form 8962, premium tax credit (ptc), calculates the amount of premium tax credit that you are allowed to claim if you have premiums for your health. Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium, or (2) to claim a. Use.

Form 8962 Printable Printable Forms Free Online

100k+ visitors in the past month Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium, or (2) to claim a. Form 8962, premium tax credit (ptc), calculates the amount of premium tax credit that you are allowed to claim if you have premiums for your health. Use.

8962 Form 2021 IRS Forms Zrivo

Form 8962, premium tax credit (ptc), calculates the amount of premium tax credit that you are allowed to claim if you have premiums for your health. 100k+ visitors in the past month Use form 8962 to “reconcile” your premium tax credit — compare. Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost.

All About IRS Form 8962 and Calculating Your Premium Tax Credit Nasdaq

Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium, or (2) to claim a. Form 8962, premium tax credit (ptc), calculates the amount of premium tax credit that you are allowed to claim if you have premiums for your health. Use form 8962 to “reconcile” your premium.

8962 Form 2021 Printable Printable Calendars AT A GLANCE

Form 8962, premium tax credit (ptc), calculates the amount of premium tax credit that you are allowed to claim if you have premiums for your health. Use form 8962 to “reconcile” your premium tax credit — compare. Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium, or.

Form 8962 Is Used Either (1) To Reconcile A Premium Tax Credit Advanced Payment Toward The Cost Of A Health Insurance Premium, Or (2) To Claim A.

100k+ visitors in the past month Use form 8962 to “reconcile” your premium tax credit — compare. Form 8962, premium tax credit (ptc), calculates the amount of premium tax credit that you are allowed to claim if you have premiums for your health.